We have exciting news for you! We have unveiled several new withdrawal methods specifically designed for our workforce in the Philippines, Indonesia, Malaysia, Singapore, Thailand, Vietnam and Egypt! With the goal of improving accessibility and user satisfaction, our platform now supports more withdrawal options as viable options for cashing out earnings. This move reflects Microworkers’ commitment to adapting to the needs of our workers, ensuring that they can quickly and easily access their funds.

Microworkers’ decision to implement these new withdrawal options is rooted in understanding the unique challenges faced by workers in the said countries. Our platform recognizes that many of our workers prefer digital payment methods. By adding these diverse options, Microworkers empowers its workers by allowing them to choose the most convenient and efficient way to manage their earnings. This initiative not only enhances the cash-out process but also aims to increase overall worker satisfaction.

Benefits of the New Withdrawal Options

These new withdrawal methods offer several advantages for our workers in the Philippines, Indonesia, Malaysia, Singapore, Vietnam, Thailand and Egypt:

- Accessibility: Mobile wallets are widely accepted for payments, transfers, and even online shopping. Workers can immediately use their earnings to pay bills, shop online, or transfer money, directly from their chosen digital wallet or bank account.

- Ease of Use: Many of these options are user-friendly and widely accepted for everyday transactions, making it easier for workers to use their earnings directly.

- Enhanced Financial Inclusion: With options of these e-wallets, workers who do not have traditional bank accounts can still receive and manage their payments quickly and efficiently.

- Faster Transactions: Many of these methods, particularly mobile wallets, offer near-instant access to funds. Digital wallets typically offer faster processing times compared to traditional banking methods. Workers can access their funds more quickly.

- Flexibility: With multiple options available, workers can choose from multiple withdrawal methods based on their preferences and convenience.

- Lower Fees: E-wallets and local bank transfers generally have lower fees compared to international payment methods, maximizing the workers’ net earnings.

- Security: Bank transfers offer a secure way to move larger sums directly to a bank account, while mobile wallets provide additional security features like OTPs and biometric authentication.

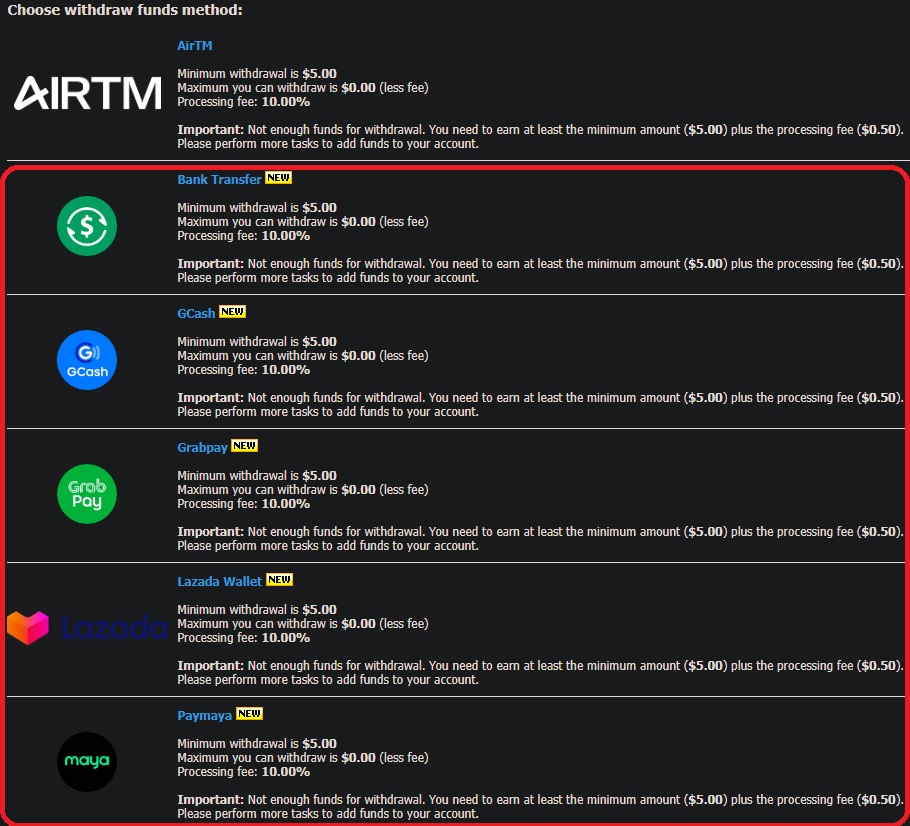

How to Withdraw Earnings Using the New Withdrawal Options

Here is a step-by-step tutorial on how to withdraw your earnings using each of the new withdrawal methods available on Microworkers.

Philippines

-

GCash

GCash is a popular mobile wallet in the Philippines, offering users a convenient way to pay bills, send money, shop online, invest and save. Also, borrow loans and credits. It allows users to perform a wide range of financial transactions through their smartphones.

Steps to Withdraw Using GCash:

- Log in to your Microworkers account and go to the “Withdrawal” section.

- Choose “GCash” from the list of available withdrawal methods.

- Enter the amount you wish to withdraw and your GCash mobile number as well as your name.

- Input verification PIN and submit the withdrawal request.

- Once your withdrawal has been approved, you will receive a confirmation SMS from GCash when the funds are deposited into your account.

Processing Time: Typically within minutes to an hour.

-

Bank Transfer

For workers who prefer direct deposits into their bank accounts, Microworkers now supports bank transfers to any local bank in the Philippines.

Steps to Withdraw Using Bank Transfer:

- Access the “Withdrawal” section in your Microworkers account.

- Select “Bank Transfer” as your preferred withdrawal method.

- Specify the amount you wish to withdraw

- Decide on which bank you wish to use for the transfer

- Enter your bank account details, including the bank account number and your account name

- Submit the request, and the funds will be transferred to your bank account once approved

Processing Time: 1-3 business days, depending on your bank.

-

PayMaya

PayMaya is another widely used e-wallet in the Philippines, providing users with a virtual card for online shopping and money transfer services.

Steps to Withdraw Using PayMaya:

- Access your Microworkers account and click on “Withdrawal“.

- Choose “PayMaya” as the withdrawal method.

- Enter your PayMaya mobile number and the amount to withdraw.

- Confirm and submit the request.

- The funds should appear in your PayMaya wallet almost instantly, or within a few hours.

Processing Time: Usually within a few minutes to an hour.

-

GrabPay

GrabPay, associated with the Grab app, is a digital wallet that offers cashless payments for various services such as ride-hailing, food delivery, and online shopping.

Steps to Withdraw Using GrabPay:

- Log in to your Microworkers account and select the “Withdrawal” tab.

- Opt for “GrabPay” as your chosen withdrawal method.

- Provide your GrabPay wallet details and enter the amount you want to withdraw.

- Confirm the transaction and wait for the funds to be transferred, usually within a few minutes.

Processing Time: Typically within minutes.

-

Lazada Wallet

Lazada Wallet is a convenient option for those who frequently shop online, particularly on Lazada. This e-wallet allows users to store funds and make quick purchases.

Steps to Withdraw Using Lazada Wallet:

- Go to your Microworkers account and click on the “Withdrawal” option.

- Select “Lazada Wallet” from the list of withdrawal methods.

- Input your Lazada Wallet information and specify the amount for withdrawal.

- Submit the withdrawal request.

- Funds should be transferred to your Lazada Wallet instantly

Processing Time: Generally real time transfer, in other words, in an instant.

***For the remaining withdrawal options listed below, the same withdrawal procedures are to be followed.

Indonesia

-

Bank Transfer

Bank transfers remain a reliable option for workers who prefer to receive their earnings directly into their bank accounts. This method ensures security and is ideal for those who manage larger sums or require a direct deposit into their savings or checking accounts.

-

DANA

DANA is a popular digital wallet in Indonesia, offering users the ability to make payments, transfers, and manage their finances seamlessly. Its integration with various online platforms and its widespread acceptance makes it a convenient choice for Microworkers in the region.

-

GoPay

GoPay, part of the Gojek ecosystem, is widely used in Indonesia for both online and offline transactions. It provides users with a secure and fast way to receive and spend their earnings, making it a preferred choice for many workers.

-

LINKAJA

LINKAJA is another prominent e-wallet in Indonesia, known for its extensive range of services, including payments, transfers, and bill settlements. Its wide acceptance and ease of use make it a valuable addition to the withdrawal options on Microworkers.

-

OVO

OVO is a leading digital payment platform in Indonesia, offering various financial services from payments to investments. It is widely used across the country, particularly in retail and e-commerce, providing Microworkers with a flexible and convenient way to access their earnings.

-

ShopeePay

ShopeePay is an e-wallet linked to the popular e-commerce platform Shopee. Allows users to make seamless transactions both within and outside the Shopee ecosystem. This integration offers added convenience for workers who frequently use Shopee for purchases and other services.

Malaysia

-

Bank Transfer

For those who prefer traditional methods, bank transfers are available. It allows Malaysian workers to receive their earnings directly into their bank accounts. This method is secure, reliable, and ideal for managing larger amounts of money.

-

Touch ‘n Go

Touch ‘n Go is a well-known e-wallet in Malaysia, initially designed for toll payments but now widely used for online shopping, bill payments, and more. Its inclusion as a withdrawal option on Microworkers provides Malaysian workers with a quick and efficient way to access their funds.

Singapore

-

Bank Transfer

Singaporean workers can benefit from the security and efficiency of bank transfers, which allow earnings to be deposited directly into their bank accounts. Those who manage larger transactions will find this method reliable and ideal.

-

Paynow

PayNow is a fast and popular payment method in Singapore that allows users to send and receive money using just a mobile number or NRIC/FIN. Workers have the option to use this method, which offers immediate access to funds and is widely accepted throughout the country, making it a convenient choice.

PayNow is a fast and popular payment method in Singapore that allows users to send and receive money using just a mobile number or NRIC/FIN. Workers have the option to use this method, which offers immediate access to funds and is widely accepted throughout the country, making it a convenient choice.

📝 Important Note:

Minimum withdrawal amount for “Bank Transfer” and “PayNow” is $50.00

Thailand

-

Bank Transfer

Bank transfers are a secure and reliable option for workers in Thailand. They are able to receive their earnings directly into their local bank accounts through this. For those who prioritize security and want to manage their money within the banking system, this method is perfect.

-

True Money

TrueMoney is a widely used digital wallet in Thailand, offering a quick and convenient way to handle payments and transfers. Thai workers can access their funds more efficiently with the inclusion of it in the Microworkers withdrawal options, especially for those who prefer digital banking over traditional banking.

📝 Important Note:

Minimum withdrawal amount for “Bank Transfer” is $50.00.

Vietnam

-

ATM Card

ATM withdrawals offer Vietnamese workers a straightforward way to access their cash directly from ATMs. Workers who opt for cash transactions or do not have access to digital wallets can benefit greatly from this method.

-

Bank Transfer

Bank transfers provide a secure and direct way for Vietnamese workers to receive their earnings. Those who prefer their funds to be deposited directly into their bank accounts can benefit from this option.

-

Zalopay

ZaloPay is a leading digital wallet in Vietnam, offering users a fast and secure way to handle transactions, pay bills, and transfer money. Its widespread use in Vietnam makes it a convenient option for Microworkers looking for a local solution to access their earnings.

Egypt

-

Aman

Aman is a popular digital payment solution in Egypt, providing services such as bill payments, mobile top-ups, and online shopping. Such wallet is widely used across the country and offers a convenient way for Microworkers to receive their earnings directly into their Aman accounts. For those who prefer digital transactions over traditional banking, this method is particularly beneficial.

2. Bank Transfer

Direct bank transfers are available for workers who prefer to have their earnings deposited directly into their local bank accounts. Managing large amounts of money or transferring funds to a savings or checking account is made easier with this method’s security and reliability. Bank transfers typically take 1-3 business days to process.

-

Card

Microworkers also supports withdrawals directly to a card. This option is convenient for workers who prefer to use their earnings for online shopping or at ATMs. The ability to withdraw directly to a card provides flexibility and ease of access to funds whenever needed.

-

Etisalat

Etisalat Cash is a mobile money service offered by one of Egypt’s largest telecom providers, Etisalat. Workers can send and receive money, pay bills, and top up their mobile phones through this. For Microworkers, using Etisalat Cash as a withdrawal option means they can access their earnings quickly and easily via their mobile phones.

-

Fawry

Fawry is a leading electronic payment network in Egypt, offering a range of services including bill payments, mobile top-ups, and online payments. Thousands of retail locations across Egypt have it available, making it a highly accessible option for workers. By choosing Fawry, Microworkers can conveniently withdraw their earnings and use them for everyday transactions.

-

Orange Money

Orange Money is another popular mobile wallet service in Egypt, provided by the telecom company Orange. Allowing users to perform various transactions such as sending money, paying bills, and topping up mobile credit. Definitely ideal for Microworkers who prefer to manage their earnings through their mobile devices without the need for a bank account.

-

Vodafone

Vodafone Cash is a mobile payment service offered by Vodafone Egypt, enabling users to send money, pay bills, and make purchases using their mobile phones. Vodafone Cash provides a quick and easy way to access their earnings, especially for those who are already Vodafone subscribers and familiar with the service.

📝 Important Tips:

– Ensure Your Account is Verified. Many e-wallets and banks require that your account is fully verified before accepting incoming transactions.

– Always check that the bank/e-wallet details are correct before submitting your withdrawal request. Errors in account information can lead to delays or failed transactions.

– Keep Your Mobile Wallet or Bank App Updated. Ensure that your mobile wallet or bank app is updated to the latest version to avoid any technical issues during the transaction process. An outdated app might not work properly, leading to delays or failures.

– Be Aware of Withdrawal Fees. Each withdrawal request is subject to a corresponding processing fee.

– Keep updated. Follow our official social media channels and subscribe to our newsletter to stay informed about new features and updates.

📒 Note:

For every successful withdrawal, you will receive an email from Microworkers informing you about the withdrawal details. A payout statement is included in the email. Unsubscribing is an option if you don’t want to receive these emails.

The introduction of these new withdrawal methods is a testament to our commitment to improving the experience of our workers across Southeast Asia and Egypt. Whether through e-wallets, bank transfers, or digital payment systems, there’s a suitable option for every worker to enjoy a seamless payment experience!

🦸Are you now ready to withdraw your earnings using these new withdrawal options? Login or create your account here and elevate your finances to the innovative level.

No Comments so far.

Your Reply